Dollar Index is the key index watchable for all traders.

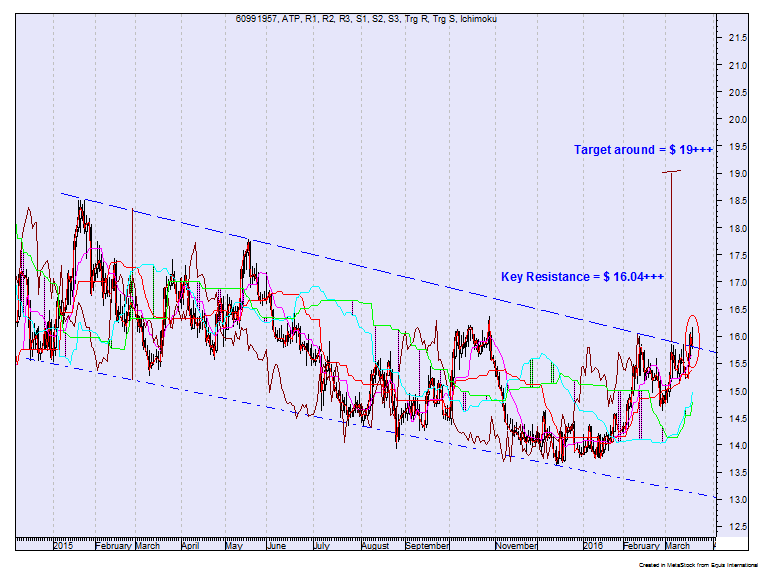

On Technical point of view

Bulls and bear share equal field of playing

Short term trend side ways

Positional Dollar Index in Bullish phase

Where 100.40/101.25 key levels to watch closing basis

Only professionals understand Importance of closing basis.

Before enter in financial market trading

Get Trained Yourself.

Technically Yours,

Team Technical IQ

Jaipur