Lead trading its near term Solid resistance/Supply zone 119.25-120.25.

And for now 118 serve as a good support price.

Something unexpected happen soon

Our Short term target above supply area 124.75.

Lead trading its near term Solid resistance/Supply zone 119.25-120.25.

And for now 118 serve as a good support price.

Something unexpected happen soon

Our Short term target above supply area 124.75.

Better Wait for Policy

Technical support Bank Nifty 15075 …. More Panic only below this.

Nifty if manage below 7550 …. 7515/7470 on cards

Bulls only take command above 7605 today

Best of Luck

We are watching carefully to Dewan Housing and Chemicals for bullish trade…

But where are the confirmation point for long ….

and Stoploss points ?????

All not free You have to start work for you.

Spend sometime for Chart Reading

Gold making new recent high yesterday (almost kissed 27000) ….

We told you Gold has demand zone around 26500 (MCX) / 1111 (COMEX) (Add on time for positional trader)

Check our previous post

Positional trader will be the only winner and happy

We are still looking more upside in Gold, But

Where is the profit booking area ???

To know more about positional view subscribe us

As we have seen Jeera next months fail to cross 13800 level

13800 our make or break point

We also consider 13400 very crucial support closing basis

If Prices manage below this….

We revise our view and looking more downside in future

Positionally Jeera may Test 12400 and more more panic ahead

Just remember 13425 (Next month) for investing

We recommend you to buy UPL at 400

Our short term positional target done at 430 in next three days (We were hoping next two days – but nothing matter much as our system keep us bullish side)

For us its Party time

Check our short term positional view on Motherson Sumi, TV18 Broadcast, Vakrangee and many more

We are not mentioning targets here only to show off ….. Its just try to let you know how “System trading is very Important for a Trader/Investor”.

Its our true Initiative to spread Education about market methodologies.

(We believe in wealth generation ….. Day Trader only can earn Bread and butter never create wealth).

…………………………………………………………………………….

Now UPL traded at 437.

So Whats the next….. Time to book profit

or trailing it with profit stoploss ???

To Answer learn How to read Technical Charts

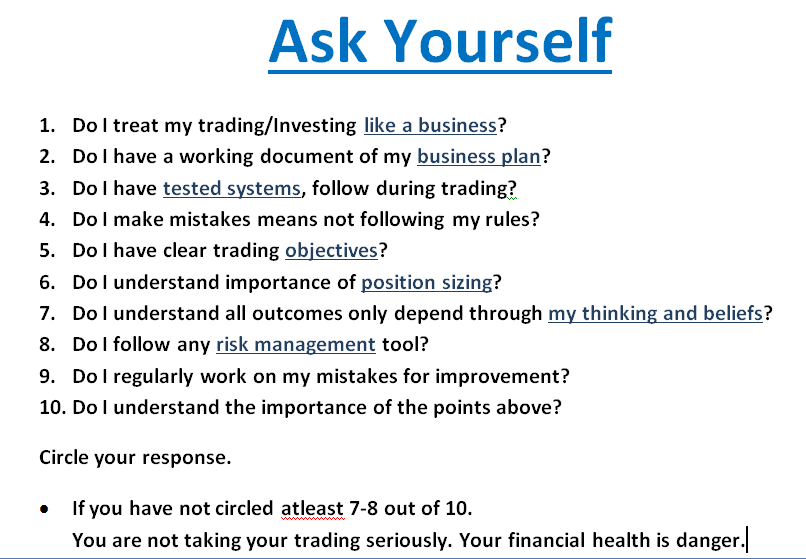

I do believe “YOU” is the most Imp factor in any kind of investment/trading practice.

Its not your procedure not your system not your position sizing not even market itself.

“You” only trade YOUR Beliefs about the market.

Work on “YOU” first then others things.

How u look the market / Whats your vision about markets ???

Are you really ready for market or just the source of brokers commission ???

Understand — These markets are made like this

Entry if very easy —>>> Just filling the form — Margin Cheque & Plus Minus Plus Minus & so on

Happy Broker

And the best thing which is going on now a days…..

E.g.

Assumption: We just consider Analysis is 100 % perfect.

Case 1. (Brokers Interest – Day Trader – Most trader trade like this) We are looking 7410 (Its your Advisers view not yours – A Person does not know your trading objectives)

And feeding you like this: above 7410 We look at 7450 then 7475 then 7520 then 7570 then 7650 then 7750 ….. and on…….

Case 2. (Profession trader way to see market – real worth maker) We are Bullish above 7410 (Go long) with defined risk and above 7475 close (Professional trader understand ) we add more Positional Target 7750 around (Exit point) – All documented

What is the Difference: Must be –

In case 2 Trader seems trained, Independent to take decision and have clear view about the market and address Risk n/Trading Psychology Naturally. Avoid many trades (Brokers Interest) and have very bright chance to make money.

In Case 1 Trader dependent, In n Out again n again n again in day itself, Just dancing as markets want him/her to dance. Very less chance of success. Finally loose their motto, blame others, seek excuses n ” Called this business – Satta”.

————————————————————————————————————

A Market winner must has perfection of following skills –

” Training is the core of success”.

Run to Catch Tata Gobal Beverages with opening bell

In next week we seen sharp recovery in prices

127 is our make or break point

To know more about targets and stop loss subcribe us.

Join Us

We deliver what u require

www.technicaliq.com, markets view is purely based on general guidelines of Technical Analysis. As markets are very dynamic by nature, so forecasting of markets is subject of probabilities not certainties. Before you get started with trading in the financial markets, you should consider your trading and investment goals, objectives, trading experience and your personal risk tolerance.We do believe subscribers/viewers acting on these recommendations or views after assuming all the risk involved then reach to actual judgment for buy or sell. Our site will never ever create any intention for bad information. This is only for your information and guidance. For more information visit: