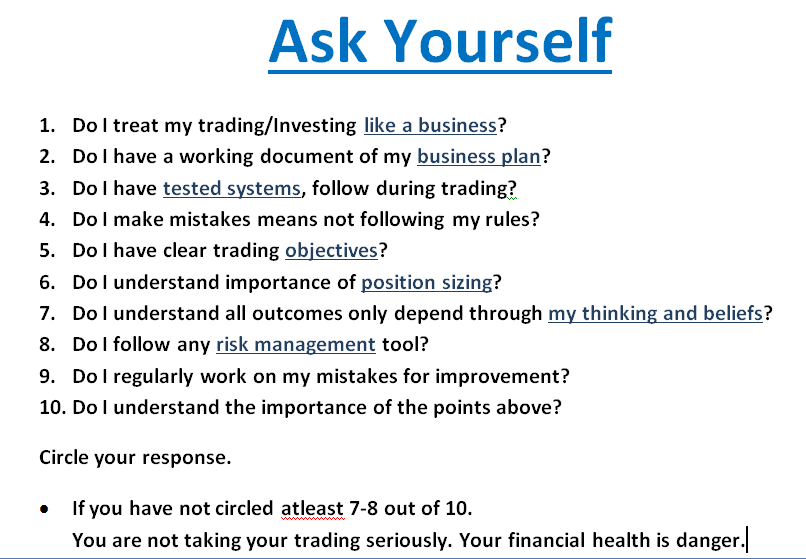

How u look the market / Whats your vision about markets ???

Are you really ready for market or just the source of brokers commission ???

Understand — These markets are made like this

Entry if very easy —>>> Just filling the form — Margin Cheque & Plus Minus Plus Minus & so on

Happy Broker

And the best thing which is going on now a days…..

E.g.

Assumption: We just consider Analysis is 100 % perfect.

Case 1. (Brokers Interest – Day Trader – Most trader trade like this) We are looking 7410 (Its your Advisers view not yours – A Person does not know your trading objectives)

And feeding you like this: above 7410 We look at 7450 then 7475 then 7520 then 7570 then 7650 then 7750 ….. and on…….

Case 2. (Profession trader way to see market – real worth maker) We are Bullish above 7410 (Go long) with defined risk and above 7475 close (Professional trader understand ) we add more Positional Target 7750 around (Exit point) – All documented

What is the Difference: Must be –

In case 2 Trader seems trained, Independent to take decision and have clear view about the market and address Risk n/Trading Psychology Naturally. Avoid many trades (Brokers Interest) and have very bright chance to make money.

In Case 1 Trader dependent, In n Out again n again n again in day itself, Just dancing as markets want him/her to dance. Very less chance of success. Finally loose their motto, blame others, seek excuses n ” Called this business – Satta”.

————————————————————————————————————

A Market winner must has perfection of following skills –

” Training is the core of success”.