We Intact same positional view on Nifty

Keep yourself long on Nifty above 7088 (better weekly) closing basis.

Targeting 7215 ……. 7450 (Long term trend decider – LOC) ++ in short term.

Same LOC for Bank Nifty is 13950 closing basis.

Intraday may rally above 14278

Targeting 14606 …… 14736.60.

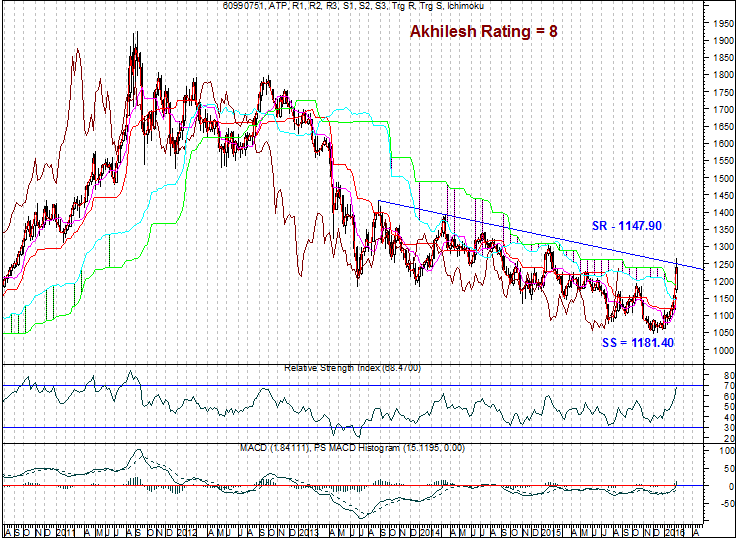

*Note: Avoid to long Nifty/Bank NIfty aggressively if USDINR traded above its key resistance level i.e. 68.5975

Market Analysis is subject of probabilities/Possibilities not certainties.

Technically Yours,

Team Technical IQ,

Jaipur.