On charts Nifty struggle to maintain on upper levels.

and again n again test its LoC (Line of control) i.e. 7450

Before any further development we use minus button below 7450 targeting previous low then 7080.

and above that market may retraced upto 7685.

Means:

7685 (Upper range)

7450 (LoC)

7080 (Lower support)

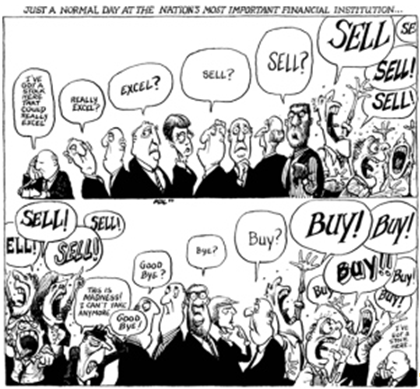

Markets are subject of probability not certainty – Understand risk.

Positional traders always relaxed and feel like Super Star.

Time to watch—

Go long in chana next if price maintained above 4142 and buy more above 4167

With sL of 41– ???

To know more follow us.— Akhilesh Jain (@Jainisakhilesh) February 7, 2016

There is no alternative of Education.

Go Long on Sadbhav Eng. above 315.05 or also in dips until stock not close below 209.80.

Your market watch may display soon

327.80 and more n more

Trained market viewer is the gainer these days in markets.

With strict discipline in Market Analysis ..

We are majoring 7450-7390 is huge demand area for Spot Nifty.

![]()

LoC (Line of control) 7365 closes for us. and we are recommending to buy Nifty on dips in demand area.

Targeting 7565 / 7599 soon

Above 7605.20 trade with volumes we will be aggressively bullish and add more n more more

Targets upto 7751 and more…… in medium term.

Being an Investor develop a habit to trade positionally. This habit only makes you wealthy.

Our followers know 100 % and updated the same timely

.

We are optimistic on Jeera, Chana and Guargum price for short term trading prospects.

Go long in chana next if price maintained above 4142 and add more above 4167 (see the blast)

With stoploss of 41– …… ???

Targets on card 4224 and …. +++

LoC (Bulls n Bear line of control) for Jeera 13750 closing basis.

LoC for Guargum ????

To know more follow us.

The way we minted money…

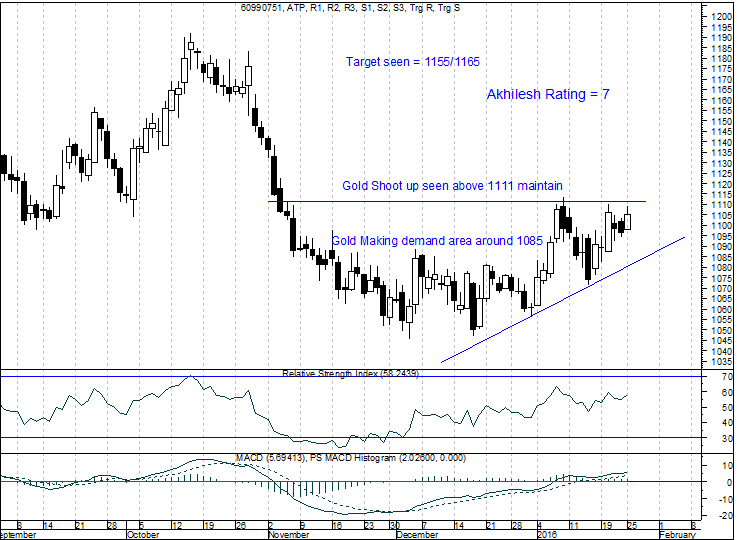

Bullish on Gold above 1085 (went long)

Add more lots above 1111

With predefined Targets (Exit points) of 1155/1165 +++ Both attained (Six trading sessions) in last trading session.

But its not matter much if u don’t know about stop loss and position sizing.

Now we stand aside and waiting for more Technical clues ….. (We can do jobbing also here near supply point as most of traders do, But we never as we told you, We only believe in positional trading style).

If you understand bold words we mention here, You are on the way of success. Rest your financial health is in danger.

In Last 6 trading sessions Gold tested 27500 +++ from 26500 (Our more lots add on price level)

What else you need 1000+ and more in last six days by taking vary natural risk.

Trade after understanding Risk – Reward concept.

Now we only can say – Best of Luck & Keep learning.

if You feel “YOU” are one out of them them Its high time to get Trained

Do not do Bla Bla Bla

Winners have party tonight ….. Sorry Losers never get the Pass.

We do not say anything Followers know everything and get the party pass too.

“Explore our Gold COMEX Positional Technical View under Technically Speaking section”

We are positional traders.

www.technicaliq.com, markets view is purely based on general guidelines of Technical Analysis. As markets are very dynamic by nature, so forecasting of markets is subject of probabilities not certainties. Before you get started with trading in the financial markets, you should consider your trading and investment goals, objectives, trading experience and your personal risk tolerance.We do believe subscribers/viewers acting on these recommendations or views after assuming all the risk involved then reach to actual judgment for buy or sell. Our site will never ever create any intention for bad information. This is only for your information and guidance. For more information visit: